Contents:

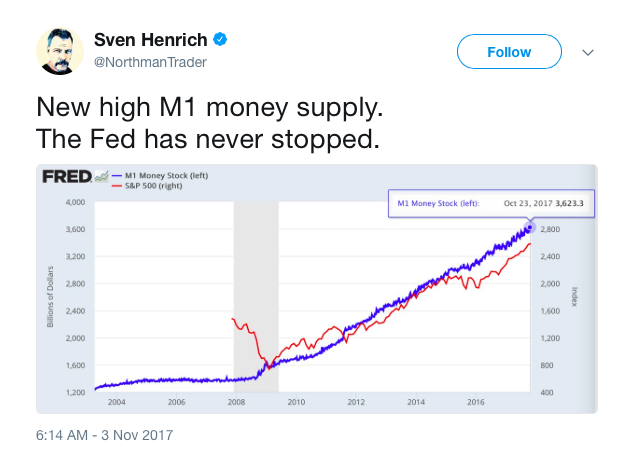

The biggest threats to consider when contemplating the Mastercard stock price forecast concern inflation and the economic impact that a setback in the fight against the pandemic would have. In late November 2021, markets were spooked by the emergence of the new, rapidly spreading Omicron variant. The company provided intelligence to governments about how stimulus cheques revived spending in particular areas, all while enabling businesses to maximise their revenues.

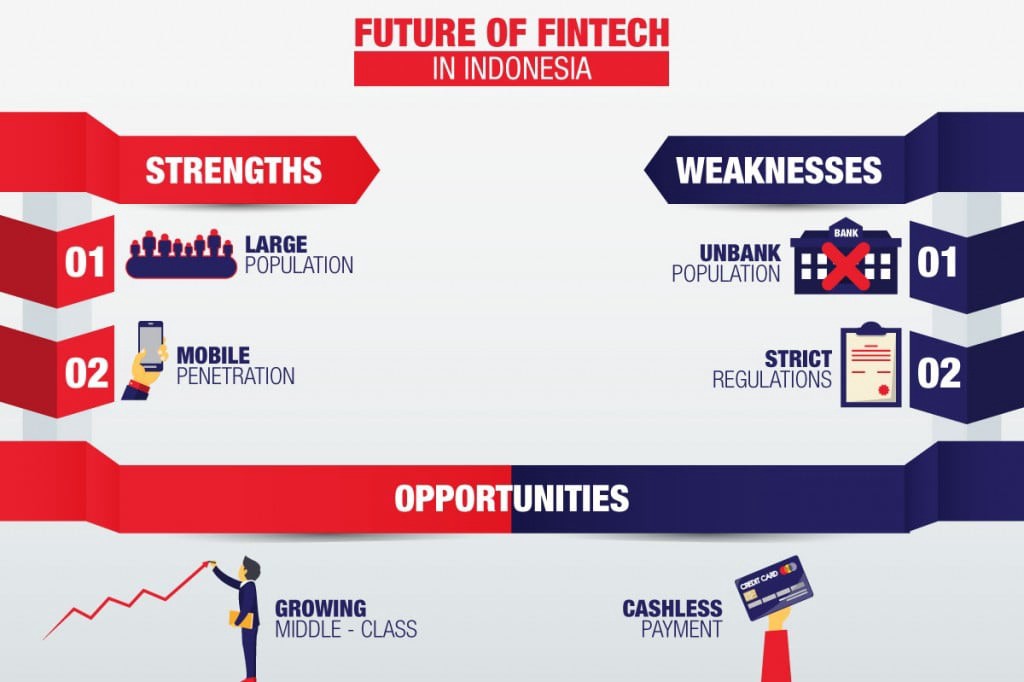

By relying on the information on this page, you acknowledge that you are acting knowingly and independently and that you accept all the risks involved. During the depths of the Coronavirus pandemic, consumers were actively discouraged from using cash because of concerns that this could cause a spike in infection rates. The desire to go cashless led to increased in-person use of credit and debit cards.

On 16 February the stock was at $381.54 having fallen from its 2022 peak of almost $400. Overall, the share price has risen 854% from its $39 opening price on the New York Stock Exchange in May 2006. 84% of retail investor accounts lose money when trading CFDs with this provider. We’re into the heart of earnings season, with many companies unveiling quarterly results daily.

Mastercard stock analysis: Technical view

In the 2021 fourth-quarter results, released in January, net revenue rose by 27% to $5.2bn (£3.9bn) – with net income up 33% to $2.4bn. With shares at $382.51, for our standard 2024 year-end exit, we expect an exit price of $678 and a total return of 80% (16.4% annualized). Mastercard has repurchased $5.9bn of its shares in 2021, and a further $0.5bn during January 1-24. A total of $11.4bn remains authorized in the buyback program, equivalent to 3% of the current market capitalization.

In the UK, there is no stamp duty on https://1investing.in/, but there is when you buy stocks, for example. Danni Hewson, a financial analyst at AJ Bell, believes it’s too simplistic to think that all financial stocks will do well as interest rates start to rise. This represented a significant increase over the $1.6bn income figure for the corresponding period in 2020, which came with earnings per share of $1.60. Stock in has been on the rise again following a surge and decline when it published its fourth quarter results which beat market expectations.

You might also pay a broker commission or fees when buying and selling assets direct and you’d need somewhere to store them safely. When looking for Mastercard stock projections, it’s important to bear in mind that analysts’ forecasts can be wrong. Predictions are based on making fundamental and technical studies of the MA stock’s historical price pattern, but past performance does not guarantee of future results. Short-term and long-term MA (Mastercard Incorporated – Class A) stock price predictions may be different due to the different analyzed time series. The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analy…

Days Historical Data

Based on earnings estimates, Mastercard will have a dividend payout ratio of 15.97% next year. This indicates that Mastercard will be able to sustain or increase its dividend. Mastercard has a short interest ratio (“days to cover”) of 1.9, which is generally considered an acceptable ratio of short interest to trading volume.

The buyback scheme will effectively reduce the number of shares in circulation, meaning existing investors will own a greater stake in the company. Mastercard’s Net Income has grown In the last two years, rising from $8.12B to $8.69B – a growth of 7.01%. In the next year, analysts believe that Net Income will reach $12.12B – an increase of 39.47%. For the next eight years, experts predict that Mastercard’s Net Income will grow at a rate of 101.54%.

Mastercard saw a decline in short interest during the month of March. As of March 15th, there was short interest totaling 4,860,000 shares, a decline of 6.4% from the February 28th total of 5,190,000 shares. Based on an average daily trading volume, of 2,790,000 shares, the short-interest ratio is presently 1.7 days. Currently, 0.6% of the shares of the company are sold short.

Why is Mastercard stock up?

This means that analysts believe this stock is likely to outperform the market over the next twelve months. CFDs attract overnight costs to hold the trades (unless you use 1-1 leverage), which makes them more suited to short-term trading opportunities. Stocks and commodities are more normally bought and held for longer.

To see all eight challenges to consider in transfer pricing delays and terms of use please see Barchart’s disclaimer. 18 employees have rated Mastercard Chief Executive Officer Michael Miebach on Glassdoor.com. Michael Miebach has an approval rating of 100% among the company’s employees.

Dzengi Сom сlosed joint stock companyis a cryptoplatform operator and carries out activities using tokens. Certain tokens sold by Dzengi Сom сlosed joint stock company may be of value only when using the information system of Dzengi Com CJSC and the services rendered by Dzengi Com CJSC. Miebach told analysts on 27 January that cross-border levels are now higher than those in 2019, but the Omicron variant offered near-term headwinds. We appreciate passion and conviction, but we also strongly believe in giving everyone a chance to air their point of view.

Air Travel Is Booming. 2 Stocks to Buy That Aren’t Airlines.

For next year, analysts predict EPS of $12.67, which would mean an increase of 50.83%. Over the next eight years, experts predict that Mastercard’s EPS will grow at a rate of 132.51%. In the last two years, Mastercard’s Revenue has grown by 11.85%, rising from $16.88B to $18.88B. For next year, analysts predict Revenue of $25.96B, which would mean an increase of 37.45%.

Here’s Why Mastercard (NYSE:MA) Has Caught The Eye Of Investors – Yahoo Finance

Here’s Why Mastercard (NYSE:MA) Has Caught The Eye Of Investors.

Posted: Wed, 11 Jan 2023 08:00:00 GMT [source]

Over the past 10 years, even with COVID-19 impacting part of 2021, Mastercard has had a 10-year CAGR of 10.9% in revenues and 16.2% in EPS. Longer-term, COVID-19 will likely be little more than a temporary blip for Mastercard, or indeed a positive in accelerating electronic payments. Recent acquisitions subtracted about 1 ppt from EBIT growth, having increased revenue growth by 3 ppt but expense growth by 7 ppt. The company has benefitted from the increasing shift towards digital payments – and this is expected to increase further due to the enthusiasm for online shopping. The company still faces growing competition and more regulatory scrutiny, however. During the third quarter of 2021, Mastercard repurchased approximately 4.3 million shares for $1.6bn and paid $434m in dividends, according to the company’s statement.

MarketBeat has tracked 44 news articles for Mastercard this week, compared to 19 articles on an average week. Mastercard has a dividend yield of 0.61%, which is in the bottom 25% of all stocks that pay dividends. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation.

I/we have a beneficial long position in the shares of MA,V either through stock ownership, options, or other derivatives. Buybacks have reduced the share count by 1.5% year-on-year, adding to EPS growth. Q EPS was 20% above 2019, after approximately 1 ppt of currency headwinds, annualizing to a solid 10% EPS CAGR despite COVID-19. The strong Q financials were in spite of a still-incomplete recovery in cross-border volumes. Excluding lower-margin intra-Europe volumes, cross-border volumes were still 2% below 2019, so Cross-Border Volume Fees were still 5% below. The strong volume recovery propelled Mastercard earnings solidly above pre-COVID levels; all key financials are now double-digits above 2019.

The UK parliament’s Treasury Committee is examining the rising cost of card payments for businesses. It is also launching services looking at open banking, open data, and environment, social and governance . Raj Seshadri, the president of Data & Services at Mastercard, said the move reflects how the business is changing. “It’s about helping customers navigate today’s challenges and anticipating what’s next,” he said. On 15 February Mastercard said it is to expand its payments-focused consulting service with a new practice dedicated to crypto and digital currencies.

Beat the Dow Jones With This Unstoppable Dividend Stock – The Motley Fool

Beat the Dow Jones With This Unstoppable Dividend Stock.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

In the last two years, Mastercard’s Dividend per Share has grown, rising from $1.39 to $1.81 – a growth of 30.22%. In the next year, analysts believe that Dividend per Share will reach $2.17 – an increase of 19.89%. For the next eight years, the forecast is for Dividend per Share to grow by 129.48%.

Over the next eight years, experts predict that Mastercard’s Revenue will grow at a rate of 62.98%. Mastercard announced that its Board of Directors has approved a stock buyback plan on Tuesday, November 30th 2021, which allows the company to buyback $8,000,000,000.00 in shares, according to EventVestor. This buyback authorization allows the company to buy up to 2.5% of its shares through open market purchases. Shares buyback plans are usually an indication that the company’s leadership believes its stock is undervalued. Mastercard announced a quarterly dividend on Tuesday, February 14th. Shareholders of record on Friday, April 7th will be given a dividend of $0.57 per share on Tuesday, May 9th.

Latest MA News

Any comment you publish, together with your investing.com profile, will be public on investing.com and may be indexed and available through third party search engines, such as Google. We believe Mastercard has now resumed its multi-year growth trajectory. Compared to pre-COVID 2019, total volume was 36% higher in Q4 (accelerating from 31% higher in Q3) and Cross-Border ex.

Best Warren Buffett Stock to Buy: Amazon vs. Apple vs. Mastercard – Nasdaq

Best Warren Buffett Stock to Buy: Amazon vs. Apple vs. Mastercard.

Posted: Wed, 08 Mar 2023 08:00:00 GMT [source]

According to its recent investment community meeting, Mastercard believes there are significant opportunities to drive growth in consumer purchases and by capturing new payment flows. It highlighted its “consistent winning strategy” of growing its core, diversifying into new customers and geographies, and building new areas for the future. “Our performance was driven by the execution of our strategy, healthy domestic spending and solid growth in cross-border spending, which has recently returned to pre-pandemic levels,” he said. According to its 3Q earnings report, Mastercard announced adjusted third-quarter net income of $2.3bn and adjusted diluted earnings per share of $2.37 for the three months ending 30 September 2021. For the full year revenues were up 23% to $18.9bn and profits rose 25% to $10.1bn.

- Visa V and Mastercard MA are two of the steadiest performing stocks in the market.

- Shareholders of record on Friday, April 7th will be given a dividend of $0.57 per share on Tuesday, May 9th.

- The strong Q financials were in spite of a still-incomplete recovery in cross-border volumes.

- Any comment you publish, together with your investing.com profile, will be public on investing.com and may be indexed and available through third party search engines, such as Google.

- According to 21 analysts, the average rating for MA stock is “Buy.” The 12-month stock price forecast is $420.33, which is an increase of 10.60% from the latest price.

“We continue to add to our efforts in cryptocurrency services and open banking through the acquisition of CipherTrace and the planned acquisition of Aiia,” he added. Stock in global payments processorMastercardhas lifted nearly 13% in the last fortnight even with a slight dip today to $345. Embedded finance can help nonfinancial brands reach their full potential by allowing customers to transact seamlessly wherever they are, reducing the risk of cart abandonment online, says Mastercard’s… Mastercard Inc reported a fall in first-quarter profit on Thursday, as higher expenses overshadowed a surge in spending volumes. Mastercard’s Q1 results reflect solid GDV growth and higher cross-border volumes, partly offset by higher expenses related to rebates and incentives. In 2022, Mastercard’s revenue was $22.24 billion, an increase of 17.76% compared to the previous year’s $18.88 billion.